Bitcoin Halving — What you need to know

Why is the price skyrocketing after every halving?

Introduction

In 2024, we celebrated the fourth Bitcoin halving. This event, eagerly awaited by the community, is punctuated by the production of blocks on the protocol created by Satoshi Nakamoto. With the regularity of a Swiss clock, halving occurs every 210 000 blocks, i.e approximately every four years.

But, if you’ve experienced your first halving, it might be worth looking back at this event in more details.

What is the Halving?

To put it simply, halving is the date on which the number of new bitcoins issued for each new block validated by the network’s miners is halved.

As a result, miners’ rewards are halved.

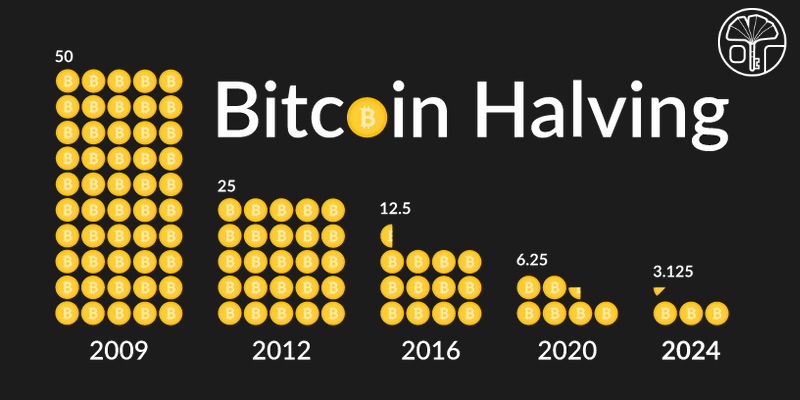

When the network was launched in 2009, the protocol generated 50 new bitcoins per block. A new block is generated approximately every 10 minutes. This time may vary slightly depending on the number of miners joining or leaving the network, but the protocol adjusts the mining difficulty to ensure that, whatever the computing power developed by the miners, they can only validate one block every 10 minutes.

The first halving of Bitcoin took place in 2012, with miners’ rewards halved to 25 bitcoins per block.

Then, the rewards were halved again in 2016 (12,5 bitcoins per block) and again in 2020 (6,25 bitcoins per block).

In 2024, the Bitcoin protocol experienced its fourth halving and the miners rewards fall to 3,125 bitcoins per block issued.

What are the consequences?

If the halving is so eagerley awaited by the community, it’s because until now, it has always been followed by a sharp rise in price.

Why is the price skyrocketing after every halving?

As we’ve just said, the more time passes, the fewer bitcoins are newly issued by the protocol. Halving creates a distortion between the issuance of new tokens, which is “abruptly” halved, and demand, which remains unchanged or even increases.

Logically, when an asset becomes scarce but demand increases, its price rises. It’s the law of supply and demand at its simplest.

This decrease in the issuance of new tokens, correlated with the maximum money supply of 21 million bitcoins, means that the last bitcoins will probably be issued in 2140. Proof that Satoshi’s work is bigger than us.

And after?

Although it’s still a long way off, how will the protocol function once the last bitcoin has been issued?

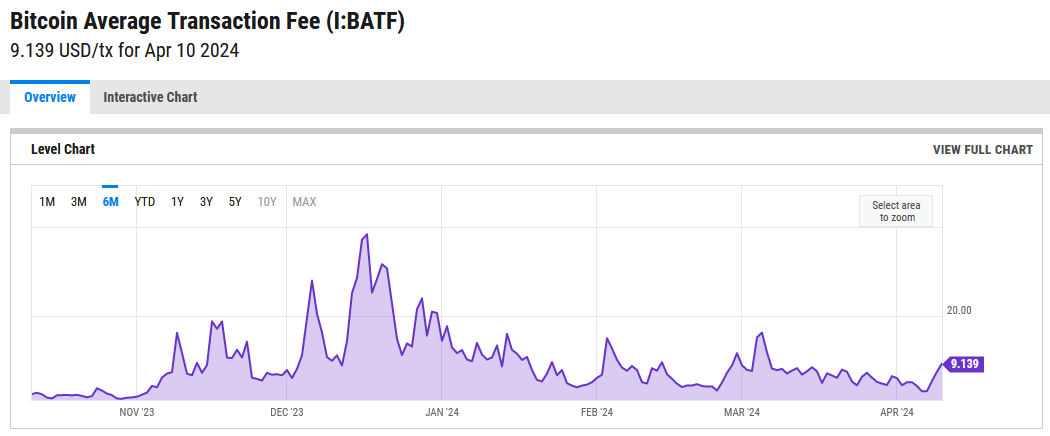

In reality, miners don’t “just” live off the new bitcoins issued by the protocol with each block. They are also remunerated by the users whose transactions they include in the validated blocks. This is known as the “transaction fee”.

Once the last halving has occurred, the miners will live solely on the transaction fees paid by network users.

It is therefore crucial that, before this date, the bitcoin network has reached a critical mass of users, and that the orange currency has appreciated sufficiently to enable miners to continue their activities.

On the other hand, every halving has major consequences for the bitcoin mining industry. In fact, there is no other industry on the planet in which participants can be sure of seeing their income halved every four years.

Miners have to find the right balance

As mentioned in the introduction, the difficulty of bitcoin mining is regularly adjusted to maintain a delay as close as possible to 10 minutes between the creation of each new block.

The more efficient the mining equipment, the greater the number of miners, and the greater the difficulty. Miners therefore engage in a race for power, which in turn increases difficulty, creating a loop that increases the security of the bitcoin network.

The higher the difficulty of mining, the more difficult it is for an attacker to take control of the network.

However, when halving occurs, it leads to a significant drop in miners’ income. As a result, less profitable miners are forced out of the market, as their post-halving costs can no longer be covered by the rewards generated.

In principle, miners take advantage of the rise in bitcoin prices to accumulate income that will enable them to build up a cash position from which they can draw in the event of a drop in profitability. However, market downturns can last for several years, at which point the least competitive miners find themselves in a literally untenable situation.

They can no longer count on as many rewards as during the previous cycle, and the collapse of the bitcoin price means they can no longer support themselves.

Halving is therefore a crucial economic element in the life of the bitcoin network. And whatever happens, it will continue to occur every four years, as long as the protocol is functioning and miners are available to add new blocks to the chain.